Follow Us

7 Biases Affecting Investors & Traders (and How to Outsmart Them)

Unmasking Biases in Investing and Trading – How to Outsmart Your Mind & Maximize Gains

Table of Contents

- The Psychology of Investing: Why It Matters

- Common Biases in Investing and Trading

- Cognitive Biases

- 1. Confirmation Bias

- 2. Anchoring Bias

- Emotional Biases

- 1. Loss Aversion

- 2. Overconfidence Bias

- Social Biases

- 1. Herd Mentality

- 2. FOMO and FOLO

- Strategies to Outsmart Your Biases

Think about it, ever made an investment that felt like a no-brainer, only to watch it sink faster than your enthusiasm for gym memberships? That’s not bad luck, and it’s definitely not a lack of skill. It’s your mind, subtly sabotaging you with tricks you didn’t even realize were happening.

Here’s the good news: you’re not stuck with these biases forever.

In this guide, we’re going to unpack the sneaky psychological traps that derail your profits and show you exactly how to outsmart them.

By the end, you’ll have the tools to make smarter, more confident decisions – without second-guessing every trade.

Let’s get started. Your wallet will thank you.

The Psychology of Investing: Why It Matters

Let’s get one thing straight: investing isn’t just about numbers and charts. It’s about emotions. And emotions? They’re messy.

Whether it’s excitement, fear, or plain old greed, your feelings have a way of sneaking into your financial decisions and causing trouble.

Take this for example: FOMO—Fear of Missing Out. It’s that little voice in your head whispering, “Everyone else is making money; why aren’t you?” This psychological nudge has caused more headaches than bad Wi-Fi during a Zoom call.

Remember the cryptocurrency booms? When Bitcoin hit its peaks in 2017 and 2021, millions of people jumped in, not because they understood crypto, but because they couldn’t bear the thought of being left out.

What happened next? The bubble burst, and many of those latecomers saw their investments tank.

Why does this matter? Because emotions like FOMO, greed, and panic can turn an otherwise rational investor into their own worst enemy.

Understanding how these feelings affect your decisions is the first step toward avoiding the traps that derail so many portfolios.

In short: your mindset is as important as your strategy. Master that, and you’re already ahead of most investors.

Common Biases in Investing and Trading

Your brain is a powerful tool – but sometimes, it’s like a toddler with crayons: well-meaning but prone to creating a mess.

Let’s talk about the sneaky cognitive biases that can quietly derail your investing decisions.

Cognitive Biases

1. Confirmation Bias

This bias makes you cherry-pick information that supports what you already believe.

Here’s how it looks in action:

You’re holding a stock that’s been sliding for weeks. Instead of facing the facts, you scour financial news and focus only on headlines like, “Experts Predict Rebound for Tech Stocks”. Why? Because it feels better to hear that than to admit you might be wrong.

The problem? Ignoring negative data blinds you to the full picture, and before you know it, you’re holding a sinking ship.

Quick Fix: Force yourself to seek out opinions and data that contradict your beliefs. If you think a stock is a “sure thing,” ask yourself, “What if I’m wrong?”

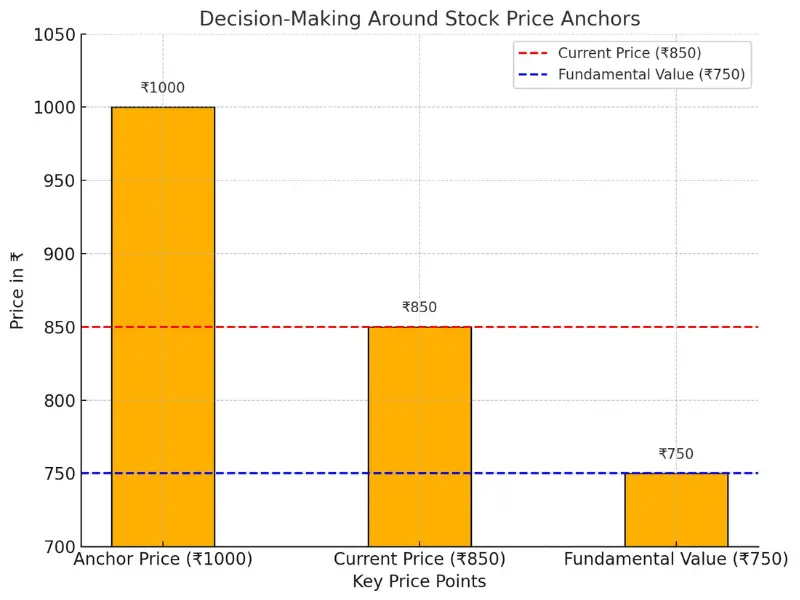

2. Anchoring Bias

Anchoring happens when you fixate on one piece of information – usually the first thing you see, and let it dictate your decisions.

Example: A stock you’ve been eyeing hit a 52-week high of ₹1,000. Now it’s trading at ₹850, and you’re convinced it’s a “steal” because of that high-water mark. But here’s the catch: the ₹1,000 price is old news. Maybe the company’s fundamentals have weakened, or market conditions have shifted.

By clinging to that anchor, you ignore more relevant data and risk making a poor decision.

Quick Fix: Instead of focusing on past prices, evaluate the stock based on its current value and future potential. Remember: what it was worth doesn’t matter – what it’s worth today does.

Emotional Biases

If cognitive biases mess with your thinking, emotional biases take it one step further—they hijack your feelings. Let’s tackle two of the most common culprits: loss aversion and overconfidence.

1. Loss Aversion

Here’s a fact: losing ₹1,000 hurts way more than the joy of gaining ₹1,000. That’s loss aversion at work, and it’s one of the biggest reasons people make bad investment decisions.

Imagine this: you bought a stock at ₹500, but it’s now sitting at ₹400. Instead of selling and cutting your losses, you hold on, thinking, “It’ll bounce back. I just need to be patient.”

You might even double down and buy more, convinced it’s a bargain. Why? Because selling feels like admitting you were wrong, and no one likes that.

The reality? Many losing stocks don’t bounce back, and holding on too long can trap your capital in poor-performing investments. Meanwhile, opportunities elsewhere pass you by.

Quick Fix: Set a stop-loss before you buy, and stick to it. Treat every trade like a business decision, not a personal battle.

2. Overconfidence Bias

This one’s sneaky. Overconfidence makes you think you’re better at predicting the market than you actually are. And when you’re riding a lucky streak, it gets even worse.

Take the GameStop short squeeze as an example. Retail investors jumped in, convinced they could outsmart hedge funds. Some did, but many underestimated the risks, betting their life savings on a rally they thought they could time perfectly. When the dust settled, many latecomers were left with heavy losses while others cashed out early.

Overconfidence gives you tunnel vision, making you ignore risks and overestimate your ability to “beat the market.” And in investing, that’s a recipe for trouble.

Quick Fix: Stay humble. Diversify your portfolio and avoid putting all your eggs in one basket, no matter how “sure” you feel.

Bottom Line: Emotional biases like loss aversion and overconfidence don’t just cost you money, they can wreck your long-term strategy. The key? Recognize when emotions are clouding your judgment, and make rules to keep them in check.

Social Biases

Social biases don’t come from your own mind—they come from the noise around you. When everyone else is shouting, it’s hard to think clearly. Let’s break down the two biggest offenders: herd mentality and FOMO/FOLO.

1. Herd Mentality

Herd mentality is exactly what it sounds like: doing what everyone else is doing because it feels safer than thinking for yourself.

Example? The meme stock craze. Stocks like GameStop and AMC shot up not because of solid fundamentals, but because thousands of people followed the crowd, hoping to cash in on the hype. Did some make money? Sure. But many others jumped in too late, only to watch their investments crash back down.

Herd mentality thrives on the belief that “everyone else must know something I don’t.” In reality, blindly following the crowd often leads you straight into trouble.

Quick Fix: Before making any move, ask yourself: “Do I actually understand why I’m investing in this?” If the answer is no, step back. Hype is not a strategy.

2. FOMO and FOLO

We’ve all felt it: that Fear of Missing Out (FOMO) when a stock starts skyrocketing, or Fear of Losing Out (FOLO) when prices start dropping fast.

Here’s how it plays out:

- FOMO: “I can’t miss this rally—everyone’s getting rich!” You buy in at the peak, only to see the price tumble.

- FOLO: “The market’s crashing—I need to sell before I lose everything!” You sell at the bottom, locking in your losses.

Both FOMO and FOLO push you to act on emotion, not logic, which is a dangerous way to manage your money.

Quick Fix: Create an investment plan and stick to it, no matter what’s happening in the market. When emotions rise, take a breather. The market isn’t going anywhere.

Bottom Line: Social biases like herd mentality and FOMO/FOLO are driven by external noise and peer pressure. To avoid getting caught up, focus on your own goals, do your own research, and trust your plan- not the crowd.

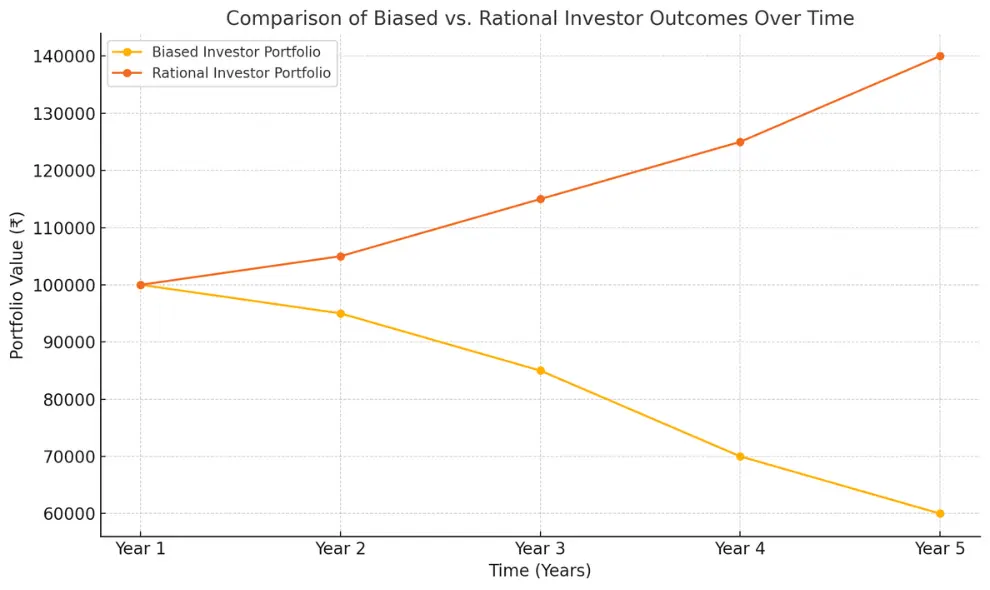

How Biases Impact Your Portfolio Performance

Your portfolio is like a mirror—it reflects your decisions, biases and all. Unfortunately, those biases can do more damage than a bad stock pick.

Let’s talk about the real-world consequences of letting emotions and flawed thinking take the wheel.

Real-World Outcomes of Biased Decision-Making

When biases run the show, your portfolio becomes a collection of mistakes:

- Holding on to losers: You keep clinging to bad investments because of loss aversion.

- Chasing trends: Herd mentality pushes you into overpriced assets, leaving you vulnerable when the bubble bursts.

- Overtrading: Overconfidence convinces you to “time the market,” often resulting in excessive fees and poor timing.

The result? Missed opportunities, poor diversification, and unnecessary losses. Instead of growing your wealth, you’re stuck playing catch-up.

Example: The Dot-Com Bubble

Here’s how biases played out during one of the most infamous market events—the Dot-com bubble.

In the late 1990s, herd mentality and FOMO took over. Investors threw money at tech companies with no real business models, just because everyone else was doing it.

Stocks of companies with barely a website were skyrocketing. People believed the hype, anchored their decisions on rising prices, and ignored the lack of fundamentals.

When the bubble burst in 2000, irrational exuberance turned to FOLO. Investors panicked and sold off not only the bad companies but also solid ones with real potential. Those who gave in to biases locked in massive losses.

But here’s the twist: investors who stepped back, analyzed the fundamentals, and held onto high-quality companies (like Amazon or Microsoft) emerged stronger in the long run. They avoided emotional decision-making and focused on rational analysis.

Strategies to Outsmart Your Biases

Biases don’t have to control your decisions. With the right strategies, you can minimize their impact and take charge of your investing. Here’s how.

1. Build Awareness

The first step to solving any problem is recognizing it. Biases often operate in the background, influencing your decisions without you even noticing.

That’s why keeping an investment journal is such a game-changer.

Here’s what to do:

- After every trade, write down:

- What decision you made (buy, sell, hold).

- Why you made it (your reasoning and emotions).

- What the outcome was (gain, loss, or still in progress).

Over time, patterns will emerge. Maybe you notice you always sell too early out of fear, or you hold onto losers too long hoping for a rebound. Awareness is the first step to breaking the cycle.

2. Use Tools and Automation

When emotions cloud your judgment, automation can help keep things on track. Let’s talk tools.

- Robo-Advisors: These automated platforms manage your portfolio based on your goals and risk tolerance. They don’t panic in market dips or chase trends—they stick to the plan, even when you might not.

- Stop-Loss Orders: A simple but powerful tool. Set a stop-loss order to automatically sell a stock if it drops below a certain price. This prevents you from holding on to losers out of hope or fear.

- Algorithmic Trading Bots: Advanced tools for traders. These bots follow pre-set rules to execute trades, keeping emotion out of the equation.

Quick Tip: Even if you’re not tech-savvy, starting with a basic stop-loss can make a big difference in neutralizing emotional decision-making.

3. Focus on Fundamentals, Not Hype

In a world where everyone’s chasing the next big thing, focusing on fundamentals is your secret weapon.

Warren Buffett, one of the greatest investors of all time, doesn’t buy into hype—he sticks to what works: fundamental analysis, intrinsic value, and margin of safety.

Here’s how it works:

- Fundamental Analysis: Buffett evaluates a company’s actual value based on its financials, not its popularity. Think earnings, debt, and growth potential—not what’s trending on social media.

- Intrinsic Value: This is the true worth of a company, determined by its ability to generate future cash flow. Buffett doesn’t buy stocks unless they’re trading below this value.

- Margin of Safety: Even if the stock’s intrinsic value looks solid, he ensures there’s a safety net by buying it at a discount to minimize risk.

The takeaway? While others chase hype, you stick to the numbers. Sure, it’s not flashy, but it works.

For example, Buffett ignored the frenzy around dot-com stocks in the late 1990s because they didn’t pass his fundamental tests. When the bubble burst, he didn’t lose a penny.

Quick Tip: Before investing, ask yourself: “Would I still buy this stock if no one was talking about it?” If the answer is no, move on.

4. Mindset Practices

Investing isn’t just about numbers, it’s about staying calm when things get messy. That’s where mindset practices come in.

- Meditation and Mindfulness:

Market volatility can trigger panic, leading to poor decisions. Practicing mindfulness helps you stay focused and avoid knee-jerk reactions.

Start small: Spend five minutes each day meditating or simply breathing deeply to center yourself. It’s not just good for your portfolio, it’s good for your sanity. - Pre-Committing with “If-Then” Scenarios:

Here’s an expert trick: Decide your actions before the emotions kick in.

Example:- “If this stock drops 10%, then I’ll sell to minimize my losses.”

- “If this stock hits my target price, then I’ll lock in profits.”

By pre-committing, you take the guesswork (and emotion) out of the equation, sticking to a rational plan no matter what the market throws at you.

Quick Tip: Write down your “if-then” scenarios for every trade. It’s like creating an emotional safety net for your investments.

Bottom Line: Focusing on fundamentals and practicing emotional discipline is a winning combo. Skip the noise, stick to the facts, and keep your head in the game, even when the market tries to mess with it. That’s how you play the long game.

Frequently Asked Questions (FAQ)

What are the most dangerous biases for traders?

The most dangerous biases for traders include confirmation bias (seeking data to support existing beliefs), loss aversion (fearing losses more than valuing gains), and overconfidence (overestimating one’s market prediction skills). These biases can lead to poor decisions and significant losses.

Can biases be completely eliminated?

No, biases can’t be completely eliminated because they’re part of human psychology. However, you can minimize their impact by building awareness, using tools like stop-loss orders, and sticking to a disciplined investment strategy.

How can beginners identify their biases?

Beginners can identify biases by:

1. Keeping an investment journal to track decisions and emotions.

2. Reviewing outcomes objectively to spot patterns (e.g., chasing trends or holding losing stocks).

3. Seeking feedback from unbiased sources or financial advisors.

Are professionals immune to biases?

No, even professionals experience biases. However, they often use structured processes, like data-driven decision-making, risk management systems, and team reviews, to mitigate their effects. Recognizing biases is key, regardless of experience level.

Conclusion:

Investing isn’t just about picking stocks; it’s about understanding yourself. Biases like confirmation bias, loss aversion, and overconfidence can quietly sabotage your financial goals.

Key Takeaways:

- Awareness: Recognize your biases by keeping an investment journal.

- Tools: Utilize stop-loss orders and robo-advisors to maintain objectivity.

- Mindset: Practice mindfulness to stay calm during market swings.

- Discipline: Stick to your investment plan, regardless of market noise.

Take Action: Start small. Choose one strategy today to address your biases and set yourself on a path to smarter investing.

Disclaimer:

This content is for informational purposes only and should not be considered financial advice.

Read full Disclaimer.