Follow Us

What Is a Realistic Profit From Day Trading? Truth Exposed

Table of Contents

Think you can quit your day job and trade your way to financial freedom?

Let’s start with a reality check:

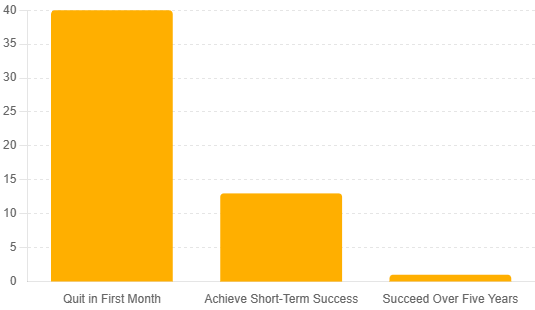

According to a study, 40% of day traders quit within their first month. Of those who stick it out, only 13% manage consistent profitability over six months, and a razor-thin 1% succeed over five years.

But before you close this tab & write off day trading as a pipe dream, hear this: success is possible.

It just doesn’t look like what the social media gurus are selling. No flashy cars or six-figure days.

Real success in trading is built on discipline, realistic goals, and knowing when to sit out the game.

This guide is for those ready to trade smart, not for thrills, but for sustainable growth.

What Percentage of Day Traders Make Money? Realistic Profits Explained

Let’s cut through the hype: day trading isn’t a shortcut to wealth. If anything, it’s a fast lane to financial frustration for most.

Forget the Instagram influencers flashing yachts & penthouses-they’re the exception, not the rule.

Here’s the truth.

Globally, fewer than 13% of traders stay consistently profitable for even six months.

A study of Brazilian day traders revealed an even grimmer reality: 97% of day traders lost money after 300 days of trading.

Among those who persisted, only 0.4% earned more than $54 per day, barely exceeding the local minimum wage.

Still here? Good. Because while the odds are tough, success isn’t impossible-it just looks different than most people expect.

The Reality of Profit Potential

Not all trading is created equal. Futures & Options (F&O) trading, for example, offers the allure of higher returns thanks to leverage.

But leverage is a double-edged sword-it amplifies gains and magnifies losses. One bad trade can wipe out years of hard-earnt money.

On the flip side, normal stock trading is slower, steadier, and, frankly, more realistic for most traders.

Instead of dreaming about doubling your money in a day, focus on smaller, achievable wins.

A 0.5%-1% daily profit might sound modest, but it’s sustainable & less likely to lead to catastrophic losses.

How Much Do Day Traders Make Per Day? Find Out What’s Realistic

Let’s set some realistic goals here. Forget the fantasy of doubling your account in a week-that’s how gamblers think, not traders.

A solid, achievable target for day traders is 1% daily returns. It might not sound cool, but here’s the thing: consistency beats wild swings every time.

Set Your Targets, Don’t Chase Unicorns

The key to hitting that 1% is sticking to technical analysis, not wishful thinking. Focus on:

- Price Action: What are the charts telling you right now? Follow the flow, not your gut.

- Support-Resistance Levels: Think of these as road signs-they tell you where the market might pause or reverse.

- Momentum Indicators: Indicators can help you gauge the strength of a trend & avoid entering at the wrong time.

Here’s a pro tip: your job isn’t to trade every single day. Your job is to wait for setups that scream “high probability.”

If the market isn’t giving you clear signals, sit out. No trade is often the best trade.

The Reality of Losses & Market Conditions

No matter how good your strategy is, losses will happen.

Let me say that again: you will lose trades.

The key is to minimize damage by avoiding revenge trading-that emotional spiral where one bad trade leads to another, & another.

Stick to your plan, cut your losses, & move on.

And let’s talk about the market’s “mood.” Not every day is filled with action.

There will be dull weeks, or even months, where the market doesn’t move enough to create strong setups.

This is normal. Instead of forcing trades in a slow market, use that time to refine your strategy or review past trades.

Why Your Starting Capital Matters

Let’s get one thing straight: in day trading, your starting capital isn’t just a number-it’s the foundation of everything you can (and can’t) do.

Whether you are trading stocks or diving into the high-stakes world of Futures & Options (F&O), your account size sets the tone for your strategy, profit potential, & risk management.

The Challenge of Smaller Accounts

Starting with a smaller account? You’re already facing some uphill battles.

- Scaling Profits:

Smaller accounts make it harder to grow consistently. If you’re targeting 1% daily profits, a $1,000 account nets you just $10 per day-not exactly life-changing.

Scaling up with a small account also amplifies risks, as even a minor loss can quickly eat into your capital. - Fees & Costs:

Trading costs like broker fees, taxes, & platform subscriptions hit smaller accounts harder.

For example, a $5 commission on a $50 profit is a 10% bite, whereas the same fee on a $500 profit is only 1%. - Risk Constraints:

With limited funds, your options for diversification shrink. This means each trade carries more weight, making it harder to absorb losses without derailing your account.

Why Bigger Is not Always Better

Having more capital offers flexibility, but don’t fall into the trap of thinking it guarantees success. Bigger accounts allow for:

- Diversification: Reducing overall risk by spreading trades across assets.

- Lower Percentage Risk Per Trade: With $50,000, risking 1% means $500-a manageable amount that can still yield significant returns.

- Absorbing Losses: A $1,000 loss hits harder on a $10,000 account than on a $100,000 one.

But here’s the kicker: even with a large account, undisciplined trading will drain it just as fast as a smaller one.

Why Reviewing Your Results Is Critical

Day trading isn’t just about the trades you make-it’s about what you learn from them.

Without regular reviews, you’re flying blind, and that’s a surefire way to stay stuck in mediocrity (or worse, losses).

The markets don’t care about your ego; if you are not beating the benchmarks, it’s time to take a hard look at what you’re doing wrong.

Are You Beating the Market?

Here’s the uncomfortable truth: if your annual returns don’t outpace the market indices, your efforts might not be worth it.

The S&P 500 & Nifty50 yield an average of 10%-12% annually with minimal effort-just buy, hold, and let time do the heavy lifting.

As a day trader, you’re taking on significantly more risk & effort, so your yearly profits should reflect that.

Set Your Benchmark:

- If you’re not earning at least 14%-15% profit yearly for three consecutive years, it’s time to reassess your approach.

- A consistent underperformance means your strategy isn’t working, or you’re failing to adapt to the market’s changes.

Still Have Questions?

How often should I trade?

Trade only when your technical analysis shows a high-probability setup.

This isn’t about clocking in daily; it is about waiting for the right opportunities.

Some days or even weeks might pass without a single trade, & that’s okay.

Is 1% daily profit realistic?

Yes, but it requires discipline, experience, & a solid strategy. While 1% is achievable, it’s not guaranteed every day.

You will have days with losses, no trades, or smaller gains.

Focus on consistency over time rather than hitting 1% every single day.

What is a realistic daily return for day trading?

A realistic daily return is 0.5%-1% of your trading capital for experienced traders.

Anything higher comes with significantly higher risk & is often unsustainable.

Remember, the goal isn’t just to make money, it’s to protect your capital & grow it steadily.

Is day trading worth it?

It depends. If you’re ready to put in the time, learn the skills & stay disciplined, it can be rewarding. But let’s be honest: day trading isn’t for everyone.

The stress, the risks, and the steep learning curve mean it’s a tough path.

If you’re not beating the market consistently (at least 14%-15% yearly), consider alternatives like swing trading or long-term investing, which are less stressful and often more rewarding over time.

Your Next Steps

Here’s the bottom line: day trading isn’t about hitting home runs-it’s about showing up, sticking to your strategy, & making steady progress over time.

Forget the flashy promises of overnight wealth. Instead, focus on building habits that lead to consistent, disciplined growth.

Start with a realistic goal: 1% daily profit.

It’s not glamorous, but it’s achievable, sustainable, and powerful when compounded over time. Some days will be losses. Others will be no-trade days. And that’s all part of the game.

Disclaimer:

This content is for informational purposes only and should not be considered financial advice.

Read full Disclaimer.