Follow Us

How to Create a Stock Watchlist & Pick Winning Stocks Daily

Table of Contents

Ever felt overwhelmed staring at hundreds of stock tickers, wondering which ones deserve your attention?

It’s time to flip the script and create a stock watchlist that works for you.

The stock market is a infinite flood of data, tickers flashing by like a never-ending news feed.

Every ‘hot tip’ sounds like the next big thing , until it’s not. Trying to track it all is not just frustrating; it’s counterproductive.

What if you could silence the noise and see only the stocks that matter to you?

A well-built watchlist is more than a list; it’s your personal command center, helping you make better, faster investment decisions.

Stop chasing the market. Build a watchlist that makes the market chase you.

Why You Need to create a Stock Watchlist

- Simplify the Chaos: The market is chaotic, but your approach doesn’t have to be. A good watchlist filters out irrelevant stocks, keeping your focus razor-sharp on actionable opportunities.

- Stay Prepared: Opportunities don’t knock , they flash across your screen. With a watchlist, you’ll spot potential trades before the crowd, putting you in the driver’s seat.

- Invest with Confidence: Reacting to hype is gambling. Following a curated watchlist based on your strategy? That’s investing. When you’re focused on the right stocks, you can trade with purpose and conviction.

Stock Watchlist Basics: What It Is and What It’s Not

Definition:

A curated list of stocks you monitor closely before buying or selling. Think of it as your stock market radar, always scanning for opportunities that fit your strategy.

Common Misconceptions:

- It’s NOT a Portfolio: A watchlist isn’t your investment portfolio. It’s a shortlist of stocks you might invest in after thorough research and strategy alignment.

- It’s NOT Static: Your watchlist should evolve as market conditions change & your investment goals shift. A static watchlist is as useful as last year’s weather forecast , keep it dynamic, relevant & focused.

The Core Framework: How to Create a Winning Stock Watchlist

1. Define Your Investment Goals

Before adding a single stock, know why you’re investing.

Long-Term Growth: If you are Looking for wealth creation over years, focus on companies with strong fundamentals, consistent revenue growth, and industry leadership.

Dividends & Income: If passive income is your motto, add stocks with a history of regular dividends and stable earnings , think blue-chip companies in sectors like banking or utilities.

Short-Term Trading: If you are a Trader, look for volatile stocks with high trading volumes, tight spreads, and predictable price action patterns.

2. Choose Stock Selection Criteria

Choosing stocks isn’t about luck , it’s about filtering the market through a set of proven criteria. Here’s what to focus on:

| Metric | Investing Criteria | Trading Criteria |

| P/E Ratio | Moderate to low | Not relevant |

| Volume & Volatility | Moderate to stable | High for day trading |

| Technical Indicators | Not critical | Critical for analysis |

Key Metrics to consider while creating watchlist for Investing purposes:

Market Cap (Small Cap for Growth, Large Cap for Stability):

Companies with large market capitalizations like Reliance Industries offer stability due to their established presence, while smaller companies may offer higher growth potential but come with more risk.

P/E Ratio (Value Indicator):

A lower price-to-earnings (P/E) ratio could indicate that a stock is undervalued. For example, ITC Limited (ITC) has historically attracted value investors because of its reasonable P/E ratio.

Dividend Yield (Income-Focused):

If passive income is your goal, look for companies with a strong dividend history, like ONGC, Coal India, etc.

Earnings Growth (Future Potential):

Look for companies that consistently grow their earnings quarter after quarter.

Along with these metric, there are many metrics that should be taken into account while creating the watchlist for investing purposes.

Key Metrics to consider while creating watchlist for Trading purposes:

Price Action:

Focus on stocks that follow price action, respecting technical patterns like trendlines, support, and resistance. Avoid stocks prone to manipulation or erratic movements.

Volume & Volatility:

Look for stocks with high trading volumes & price fluctuations, ensuring liquidity and better trade execution.

Check the fundamentals:

Even while selecting stocks for trading purpose, checking the company’s fundamental is must, to ensure the company is good enough to trade.

A strong stock selection process keeps you focused and disciplined , no more emotional buys or chasing rumors.

3. Use Stock Screeners (But Be Smart)

Using stock screeners is like having a personal assistant that works 24/7 to find potential opportunities , but only if you know how to direct it.

- Start Simple:

Begin with basic filters like market cap, sector, or trading volume. - Layer in Metrics:

Add more filters as your strategy becomes clearer. Use screeners like Tickertape, Moneycontrol, TradingView, or NSE India, which allow customized searches. - Avoid Overcomplicating:

Don’t use every filter available , it will leave you with no results or overly narrow picks. Instead, focus on the criteria most relevant to your trading or investment style.

“Save your screening criteria for quick re-use, ensuring you stay consistent and never miss a potential re-scan.“

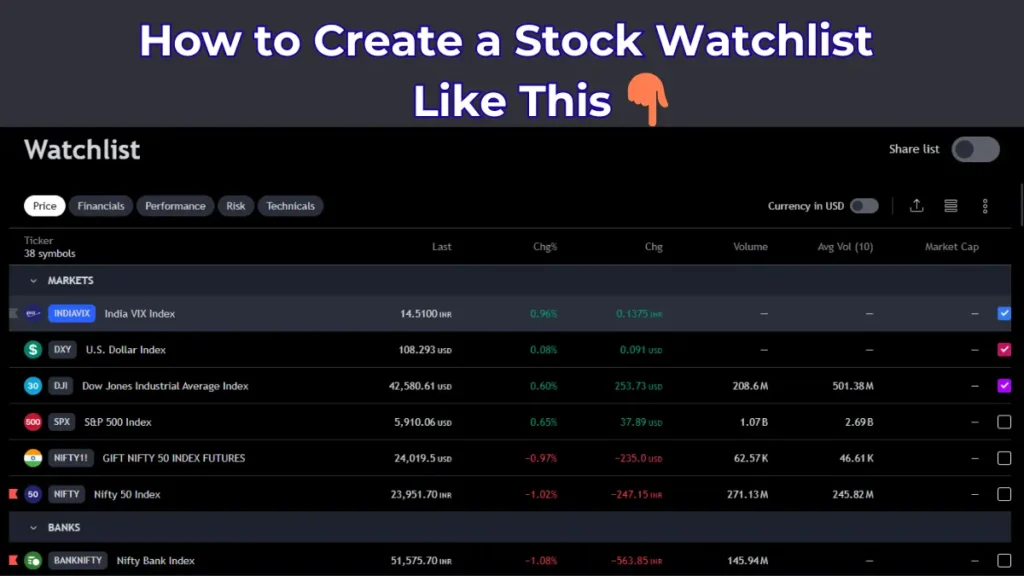

4. Track Key Market Indexes

Follow essential indexes like NIFTY 50, SENSEX, NIFTY Bank, & sector-specific indices to stay updated on market sentiment and overall economic performance.

Regularly monitor benchmark indices to gauge the broader market’s health and identify potential investment opportunities.

A rising index could signal bullish market conditions, while declining indices may hint at bearish trends.

5. Segment Your Watchlist by Sectors

Create dedicated sections for different sectors like IT, Banking, Energy, & Pharma to diversify your watchlist and reduce risk concentration.

Also, Track sector rotation trends, as sector performance can change rapidly in the Indian markets.

For example, IT stocks might surge during tech expansions, while banking stocks could rise when interest rate hikes are anticipated.

Pro Tip: Use a sector heatmap tool on platforms like TradingView or Moneycontrol to visualize sector performance at a glance and adjust your watchlist accordingly.

6. Conduct Custom Scans

Building a powerful watchlist isn’t just about numbers, it’s about digging deeper into the fundamentals.

- Analyze Company Reputation:

Look into a company’s leadership quality, corporate governance, and track record in handling industry challenges. - Monitor Insider Trading & Block Deals:

Track insider trading activity & bulk/block deals reported on exchanges. These can indicate institutional interest and confidence in the stock. - Follow Industry News & Trends:

Stay updated with the latest sector-specific news, policy changes, and global market trends that could influence stock performance.

7. Look Beyond Domestic Markets

Limiting your watchlist to domestic stocks can restrict growth potential. Expand your reach by tracking international markets.

Diversify Internationally:

Consider monitoring and tracking international markets like the U.S. (DJI, S&P 500), as they impact the whole world and its markets.

Track Emerging Market ETFs & ADRs:

Look into Emerging Market ETFs and ADRs (American Depositary Receipts) listed on foreign exchanges. These provide exposure to international companies while hedging against domestic market volatility.

Use global financial platforms like Yahoo Finance, Bloomberg, & Investing.com to stay updated on international stock movements, major indices, and breaking global financial news.

8. Incorporate Macro-Economic Indicators

Successful stock selection goes beyond company-specific metrics. Understanding the broader economic landscape helps you anticipate potential market shifts.

Keep a close eye on essential macro-economic indicators such as inflation rates, GDP growth, RBI interest rate decisions, & fiscal policies.

These factors shape the overall market environment and influence specific sectors.

Use economic calendars from trusted platforms like TradingEconomics, Investing.com, or Bloomberg to stay updated on upcoming macro-economic events and policy announcements.

9. Explore Derivatives & Options Watchlist

For experienced traders, building a derivatives and options watchlist can unlock advanced trading strategies.

Create a Separate Section:

Maintain a dedicated section in your watchlist for futures, options, and other derivatives.

Track Key Metrics:

Monitor critical metrics like implied volatility (IV), open interest (OI), strike prices, and expiration dates to identify potential trading setups.

Use for Advanced Strategies:

Derivatives can be used for short-term trading, hedging long-term positions, or implementing complex strategies like spreads and straddles.

Tools to use: Platforms like NSE India & Sensibull provide real-time options data, enabling you to monitor volatility and market sentiment with precision.

How to Use This Watchlist Effectively

End-of-Day Scan:

After the market closes, review all stocks in your watchlist. Look for significant price movements, volume spikes, or breaking news.

Price Action Analysis:

Study daily price action on charts using platforms like TradingView. Identify stocks showing promising technical patterns like breakouts, trend reversals, or support/resistance levels.

Shortlist for Next Day:

Create a condensed watchlist for the next trading session by selecting stocks with strong setups, price momentum, or upcoming market events.

Flag the shortlisted stocks, to easily find them the next day.

Set Trade Alerts:

Use trading platforms or your broker like Zerodha, TradingView, or Upstox to set alerts and notifications. This ensures you respond quickly to important price movements, minimizing missed trading opportunities.

Stay Ahead: Watchlist Management Tips

1. Update Regularly: Conduct monthly check-ins to keep your watchlist fresh and relevant.

2. Trim the Fat: Remove stocks that no longer meet your investment criteria or show declining performance.

3. Use Alerts: Set price or news alerts to stay updated on critical stock movements or company announcements.

4. Revisit Based on Performance: Continuously adjust your list based on how stocks perform relative to the broader market and more importantly your trading strategy.

5. Review Quarterly Earnings: Regularly analyze quarterly earnings reports and management commentary to stay ahead of key company developments.

6. Journal Trades & Strategy Reviews: Maintain a trading journal to record important decisions, trade outcomes, wins, and lessons learned. Use these insights to refine your watchlist management strategy over time.

Common Mistakes to Avoid (Myth-Busting)

Too Many Stocks:

Keep your watchlist lean & focused. Quality beats quantity, tracking too many stocks dilutes your focus and increases decision fatigue.

No Clear Criteria:

Avoid adding stocks based on hype or emotions. Every stock in your watchlist should meet well-defined criteria aligned with your trading or investment strategy.

Ignoring Market Trends:

Markets evolve, & so should your watchlist. Stay adaptable by tracking sector rotations, economic indicators, and global market conditions to avoid outdated picks.

FAQs Section

How many stocks should be on my watchlist?

20-40 stocks are ideal to balance depth and focus without overwhelming yourself.

How often should I update my watchlist?

Monthly or during major market events, earnings seasons, and policy announcements.

Should I add trending stocks?

Only if they fit your strategy and meet your watchlist criteria. Avoid chasing hype or speculative momentum.

Which is the best stock watchlist app?

Popular platforms include TradingView, Moneycontrol, & Investing.com. Choose one based on your trading style and feature preferences.

Your Stock Watchlist Action Plan:

1. Define Investment Goals: Clarify whether you’re focused on long-term growth, short-term trading, or passive income.

2. Choose Stock Criteria: Set clear parameters like P/E ratios, dividend yields, or price action patterns.

3. Use Screeners Wisely: Filter stocks using tools like TradingView or NSE India.

4. Build & Organize: Create a watchlist segmented by sectors or trading types.

5. Set Alerts & Notifications: Use trading platforms to get real-time updates.

6. Review & Adjust Weekly: Drop underperforming stocks and add promising ones based on updated analysis.

“Remember: In the stock market, fortune favors the prepared, not the panicked.”

Disclaimer:

This content is for informational purposes only and should not be considered financial advice.

Read full Disclaimer.