Follow Us

Rate of Return Calculator

Rate of Return Calculator

Table of Contents

Understanding the Rate of Return Calculator

When you invest money, one of the first questions that comes to mind is: How much did my investment really grow?

That’s exactly what the Rate of Return Calculator helps you figure out. Instead of just looking at how much more money you ended up with, this tool shows you the annualized return, also called CAGR (Compound Annual Growth Rate).

Why does this matter? Because CAGR gives you a clear picture of how your investment performed on average per year, even if the growth was uneven.

It smooths out the ups and downs and tells you what constant yearly rate would have taken you from your starting value to your final value.

In this post, we will break down how the calculator works, when to use it, and how to make smarter decisions by understanding your actual returns.

What Is a Rate of Return (RoR) & Why It Matters

At its core, the rate of return tells you how much you have earned on an investment relative to what you originally put in.

Let’s say you invest $10,000, and a few years later it grows to $18,500. That means your investment returned an additional $8,500, but how do you express that as a percentage over time?

That’s what RoR solves. It expresses your profit as a percentage of your original investment, adjusted for time. It is the financial equivalent of saying: “Here’s how hard my money worked for me.”

Why Rate of Return Is Important:

- Decision Clarity: It helps you compare different investment options on a level playing field.

- Reality Check: RoR cuts through emotion or speculation. You will know exactly how well something performed.

- Versatility: It applies to any investment: stocks, real estate, startups, or bonds.

Rate of Return vs Other Metrics:

While RoR tells you your total gain or loss over a custom period, it’s different from:

- Interest Rate: Often flat and not time-sensitive.

- CAGR (Compound Annual Growth Rate): A standardized annualized return; ideal for comparing long-term investments.

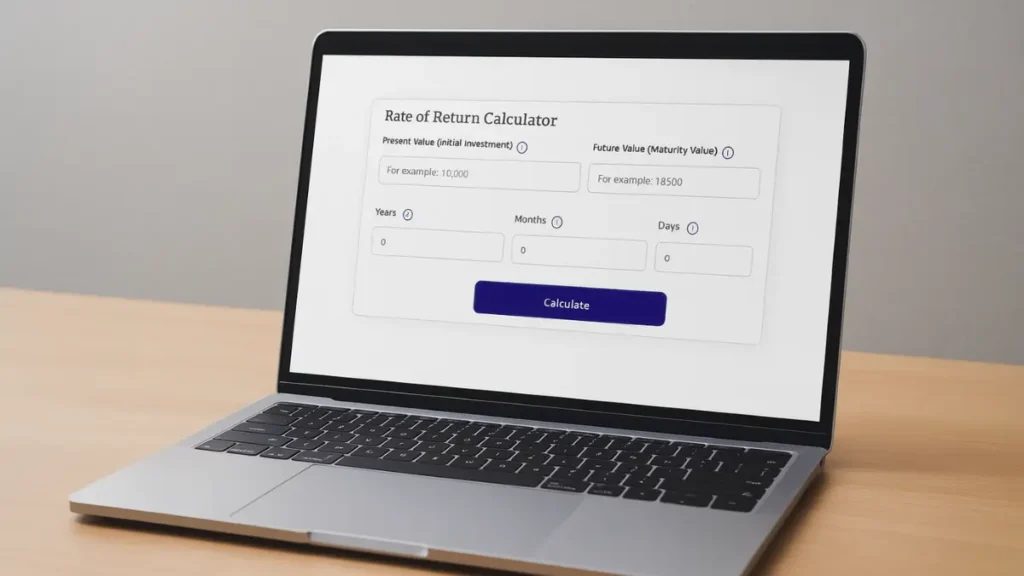

Breakdown of the Calculator: What Each Field Means

Present Value (Initial Investment)

This is how much money you started with. It could be the cost of buying a stock, your upfront payment on a rental property, or any initial capital.

Example: You invest $10,000 into a mutual fund. That’s your present value.

Future Value (Maturity Value)

This is the value of your investment at the end of the holding period. It includes any gains, dividends, or interest earned.

Example: After 3 years, your investment is worth $18,500. That’s your future value.

Time: Years, Months & Days

This is where most people mess up. Time matters a lot. Even small differences (like 3 years vs. 3 years + 45 days) can change the result. This calculator lets you be precise.

Why it matters: If your return came in 1 year instead of 3, your rate would be dramatically higher. Precision equals accuracy.

Step by Step: How to Use the Rate of Return Calculator

Let’s walk through an example to show how it all comes together:

Scenario:

- You invested $10,000 (Present Value)

- Your investment grew to $18,500 (Future Value)

- It took 3 years, 2 months, and 15 days

Here’s how you’d input it:

- Present Value: 10,000

- Future Value: 18,500

- Years: 3

- Months: 2

- Days: 15

What Happens:

The calculator takes your inputs and computes the rate of return using this logic:

Formula:

RoR = (Future Value / Present Value)1 / Time – 1That gives you a percentage return, accounting for the exact time your money was invested.

How to Interpret the Result

So let’s assume your calculator spits out an RoR of 12%, great! But is that good? It depends.

Context is Everything:

- Compared to what? If the S&P 500 delivered 9% annually during the same period, you beat the market.

- Adjusted for risk? A 12% return from a volatile crypto token carries more risk than 8% from a stable dividend ETF.

- Did you factor in fees/taxes? That 12% might drop to 9% after fees, which changes the picture entirely.

Here’s a simple rule of thumb:

A “good” rate of return is one that beats your benchmark, justifies the risk taken, and meets your personal financial goal.

Beware of High RoR Traps:

Sometimes, high returns are misleading. A 40% return in 1 month feels amazing, until you realize the next month, the asset crashed 60%. Always pair RoR with risk analysis and duration context to get the full story.

When Should You Use This Calculator?

Use It Before Investing:

Want to grow your $5,000 to $10,000 in 5 years? Use the calculator to back calculate the return required and ask: “Is this return realistic for the asset I’m considering?”

Use It After Investing:

Already sold your stock, cashed out your fund, or exited a deal? Input the start and end data to calculate your real performance.

Use It To Compare Investments:

Let’s say one investment gave you 20% in 2 years, and another gave you 30% in 5 years. Which is better? Without normalizing for time using RoR, comparisons are meaningless.

Bottom line: Use it whenever you are asking, Did I make a good return? or What return do I need to make?

Common Mistakes to Avoid

Even with a great calculator, small input errors can lead to big misinterpretations. Here are some of the most frequent (and costly) mistakes:

Ignoring Time Precision

Entering “3 years” when your investment lasted 2 years and 8 months skews your result. Always include months and days when available.

Forgetting Fees or Taxes

If your future value doesn’t account for brokerage fees, fund charges, or capital gains tax, your return is overstated. Enter net gains, not gross.

Using Projected Values as “Future Value”

If you are estimating future returns, remember: you are only running a projection, not calculating an actual return. Don’t mix hypothetical numbers with past performance.

Combine with CAGR for Long Term Insights

Rate of Return gives you a total gain over a custom time period but sometimes, you want a normalized, annualized return. That’s where CAGR (Compound Annual Growth Rate) comes in.

RoR vs. CAGR – What’s the Difference?

| Metric | What it Tells You | Best Used For |

|---|---|---|

| RoR | Total return over a specific period | Custom durations, irregular periods |

| CAGR | Average annual return with compounding | Comparing long-term performance |

When to Use CAGR:

- For comparing mutual funds or ETFs over 5+ years

- When evaluating consistent growth over time

- To normalize different investment durations

Example: If you made a 50% return in 3 years, RoR tells you the total gain; CAGR tells you that it’s roughly 14.47% per year when compounded.

Using both metrics together gives you a full performance snapshot: what happened (RoR) and how fast it happened (CAGR). This Big Brain Money calculator shows both RoR and CAGR; side by side, in one place.

FAQs

What is a good rate of return?

It depends on the asset. Equity mutual funds may aim for 10–15% over the long term, while fixed deposits usually give 5–7%.

Can CAGR be negative?

Yes, if the final value is lower than the initial investment, the CAGR will show a negative annualized return.

Why use CAGR instead of average returns?

Average returns can be misleading when returns fluctuate. CAGR gives you the real growth rate that connects your start and end values smoothly.

Disclaimer:

This content is for informational purposes only and should not be considered financial advice.

Read full Disclaimer.