Follow Us

Stock Market 101: Mastering the Basics

Table of Contents

Imagine this: with just 10 minutes a day, you could start shaping a more prosperous financial future. Sounds pretty good, right? Almost 61% of Americans are already on board, using the stock market as their wealth-building tool of choice.

Now, I’ve spent years navigating these financial waters, and I’m here to tell you that while the stock market might seem complex, it’s really just a place where companies find the funds they need to grow and where folks like you can invest in these companies for potential gains.

Whether you’re thinking about trading for the first time or you’re looking to get more serious about your investments, understanding these basics is your first step toward making informed and profitable decisions.

Let’s break down how stock market works and make sure you’re equipped to dive into the world of stocks.

Related Article:

Types of Stocks

Understanding the Stock Market Basics

What is the Stock Market?

Let’s keep it simple. The stock market is essentially a giant, organized marketplace where securities like stocks are bought and sold.

Why does this matter to you? Well, it’s a critical engine for economic growth. It enables companies to raise money by selling shares to the public.

This funding helps them grow, innovate & hire more people, which fuels the economy further.

For you, as an investor, it offers a chance to own a slice of a company’s future profits and potentially earn some solid returns on your investment.

How Stocks are Created

Starting from the ground up, stocks begin their life through a process known as an Initial Public Offering, or IPO.

This is when a company decides to go public by offering shares for sale to the public for the first time.

It’s a big step for any company because it opens up a vast pool of potential capital from public investors.

Once the IPO is complete, these shares don’t just stick with the initial buyers. They move to what we call the secondary market, which is where you and I can buy and sell these stocks.

This market includes major stock exchanges like the NYSE, NASDAQ or NSE where the trading happens. This is the place where stock prices fluctuate based on supply and demand, market sentiment and other economic factors.

Essentially, the secondary market is where the ongoing action happens & fortunes can be made or lost.

Key Players in the Stock Market

- Traders: These are the folks who buy and sell stocks frequently, often capitalizing on short-term market fluctuations to turn a profit.

- Investors: In contrast to traders, investors are the marathon runners. They purchase stocks with the intention of holding onto them for a longer period, betting on the companies’ growth over time.

- Financial Analysts: These are the experts who dive deep into data to forecast future market trends and company performances. Their analyses help both traders and investors make more informed decisions.

- Economists: They look at the bigger picture. Economists analyze and interpret economic trends and policies to understand their impact on the stock market and overall economy.

Together, these players make the stock market a dynamic and continuously evolving platform where information, strategy, and timing decide the winners and losers.

Major Stock Exchanges and Their Influence

The global landscape of stock trading is dominated by several key exchanges, each playing a vital role in international finance.

Here’s a quick snapshot of some major players:

| Stock Exchange | Location | Notable for |

| NYSE (New York Stock Exchange) | USA | Largest in the world by market cap, known for its blue-chip companies. |

| NASDAQ | USA | Favored by tech giants, known for its high-tech and internet-related stocks. |

| LSE (London Stock Exchange) | United Kingdom | One of the oldest, housing a diverse range of companies from different countries. |

| NSE (National Stock Exchange) | India | Leading stock exchange in India, noted for its high transaction volumes. |

| ASX (Australian Securities Exchange) | Australia | Primary exchange in Australia, features a mix of well-established and growth-oriented companies. |

Each of these exchanges influences the global economy by providing the infrastructure necessary for public companies to sell their shares to investors.

Primary vs. Secondary Markets: Understanding the Distinction and Their Roles

When you start diving into the stock market, you’ll often hear about the “primary” and “secondary” markets.

Let’s clarify what these terms mean and why they matter to you as an investor.

Primary Market:

This is where securities are created. It’s the market for new issues of stocks, where companies sell new shares to the public for the first time through Initial Public Offerings (IPOs).

The primary market provides companies with the opportunity to raise capital to grow their business. When you buy shares in an IPO, your money goes directly to the company, helping it finance its operations and projects.

Secondary Market:

After stocks have been issued in the primary market, they move to the secondary market, where they are traded among investors. This is the stock market that you’re probably most familiar with, including exchanges like the NYSE and NASDAQ.

Here, investors buy and sell shares from each other, and the original issuing company is not involved in the transactions. The secondary market is crucial because it provides liquidity, allowing you to buy and sell stocks easily.

Understanding these markets is key because it helps you see how stocks flow from creation to everyday trading, impacting how you invest and manage your portfolio.

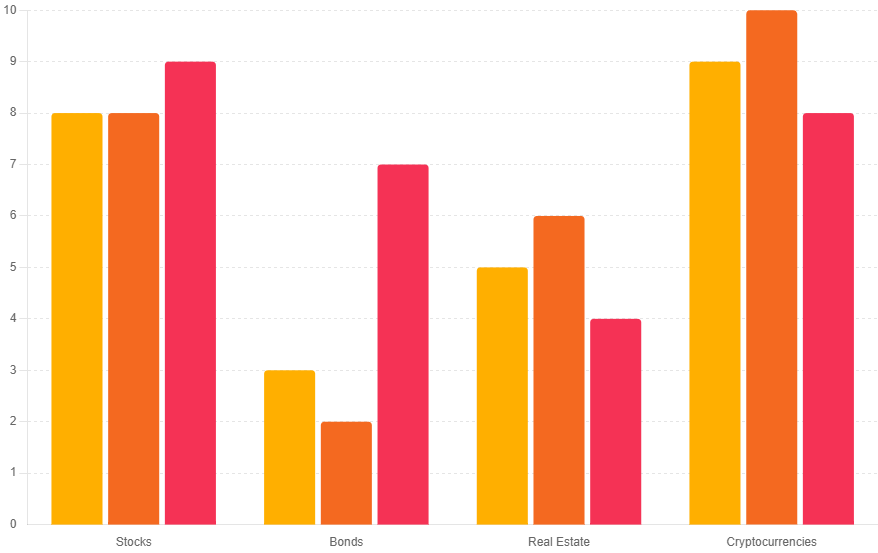

Investment Avenues & Their Competitors

Traditional Stock Investments vs. Alternatives

Exploring investment avenues isn’t just about sticking to the stock market.

Let’s compare traditional stock investments with some popular alternatives like bonds, cryptocurrency markets, and real estate.

Understanding the differences can help you diversify and balance your investment portfolio.

Stocks:

- Risk and Returns: Generally higher potential returns, but with increased volatility.

- Liquidity: Stocks are typically highly liquid, especially those traded on major exchanges.

- Impact of Economic Changes: Sensitive to market sentiments and economic indicators.

Bonds:

- Risk and Returns: Often seen as safer than stocks, bonds offer lower returns, making them appealing during volatile times.

- Liquidity: Varies widely; government bonds are usually highly liquid, whereas corporate bonds can be less so.

- Impact of Economic Changes: Interest rate changes can significantly affect bond prices; inversely related to rates.

Cryptocurrencies:

- Risk and Returns: Extremely volatile investment with potential for high returns.

- Liquidity: High liquidity for major cryptocurrencies, but can vary widely among newer or less known coins.

- Impact of Economic Changes: Less influenced by traditional economic indicators, more by technological advancements and regulatory changes.

Real Estate:

- Risk and Returns: Typically provides steady returns and can be a good hedge against inflation.

- Liquidity: Real estate is considered a non-liquid asset; converting to cash quickly can be challenging without a price concession.

- Impact of Economic Changes: Sensitive to local economic changes, interest rates, and government policies.

Each of these investment types plays a distinct role in financial strategy, offering different benefits and risks.

While stocks might give you quick gains, bonds offer stability, real estate provides tangible assets, and cryptocurrencies bring a high-risk, high-reward scenario.

Knowing how each fits into your financial goals is crucial to building a robust investment portfolio.

Factors Influencing Investment Decisions

When deciding where to invest your money, several key factors come into play. Understanding these can help you make more informed choices that align with your financial goals.

Here are the three major factors to consider:

Risk:

- The level of risk you’re willing to take is crucial. Higher-risk investments, like stocks and cryptocurrencies, can offer higher returns but also come with the chance of significant losses.

Assess your risk tolerance based on your financial situation, investment timeline, and comfort level with potential fluctuations in your investment value.

Returns:

- Returns are what everyone aims for in investing. Generally, the potential for higher returns increases with greater risk.

Evaluate the expected return of an investment to determine if it compensates adequately for the risk you’re taking.

It’s also important to compare historical performance, though past success doesn’t guarantee future results.

Liquidity:

- Liquidity refers to how quickly and easily you can convert an investment into cash without significantly affecting its price.

Stocks are typically highly liquid, especially those listed on major exchanges, whereas real estate is much less so.

Consider how soon you might need to access the funds before choosing an investment type.

Balancing these factors according to your personal finance goals, time horizon, and risk tolerance is key to crafting a successful investment strategy.

How to Analyze & Choose Stocks

Introduction to Financial Analysis and Economic Indicators

Choosing the right stocks is not just about gut feelings or following the crowd. It involves a systematic approach to financial analysis and understanding economic indicators that influence stock performance.

Let’s break down these concepts to help you make more informed investment decisions.

Financial Analysis:

- This is the backbone of stock selection. It involves scrutinizing a company’s financial statements, such as income statements, balance sheets, and cash flow statements—to assess its financial health.

- Key metrics to focus on include revenue growth, profit margins, debt levels, and return on equity. These figures can help you determine whether a company is well-managed, financially stable, and positioned for growth.

Economic Indicators:

- These are a range of macroeconomic data points that provide insight into the overall health of the economy. Common indicators include GDP growth rates, unemployment rates, inflation, and consumer confidence indices.

- These can significantly impact market performance and should influence your stock choices.

- For instance, high unemployment might indicate economic trouble, potentially harming stocks, whereas strong GDP growth could boost market sentiment.

Incorporating these elements into your investment strategy will give you a clearer picture of both a company’s individual potential and the broader economic context in which it operates.

This dual approach will equip you with the tools to select stocks that are not only strong in their own right but also aligned with economic trends for optimal performance.

Tools and Resources for Investors

Here are a couple of essentials that I always recommend to anyone looking to get a firm grip on their investments:

Financial News:

- Staying updated is key. Websites like Bloomberg and Reuters offer real-time updates and expert analyses that are invaluable. Make it a habit to check the news daily. It’s like checking the weather before heading out—it prepares you for what’s coming.

Stock Simulators:

- These are fantastic for beginners. Platforms like Investopedia’s simulator provide a risk-free way to practice trading. You’ll learn the ropes without the risk of losing real money.

Basic Stock Market Analysis Techniques: Understanding Bid and Ask Prices

Getting a handle on stock trading basics can really boost your confidence. Let’s talk about two fundamental concepts you’ll encounter daily: bid and ask prices.

Bid Price:

- This is the highest price a buyer is willing to pay for a stock. It’s like your opening offer in a negotiation.

Ask Price:

- Conversely, this is the lowest price a seller is willing to accept. Think of it as the counteroffer in your negotiation.

The difference between these two is known as the “spread.” A narrower spread often indicates a more liquid market, meaning the stock can be bought or sold quickly.

Understanding these prices gives you a snapshot of a stock’s current demand and supply, helping you make smarter trading decisions.

Remember, buying at the right time can make all the difference.

Part 3: Advanced Stock Market Concepts

Market Dynamics: Bull vs. Bear Markets

In the world of stock trading, understanding market trends is crucial.

Let’s demystify two terms you’ve probably heard: bull and bear markets.

Bull Market:

- This term describes a market that is on the rise. It is characterized by investor confidence and expectations that strong results should continue.

- If you think about a bull, with its horns thrusting upward, this symbolizes the way the market moves during these phases.

- Historically, bull markets have been associated with strong economies, low unemployment, and robust investor confidence.

Bear Market:

- In contrast, a bear market indicates a decline in the market by 20% or more from recent highs, accompanied by widespread pessimism.

- The bear’s downward swipe perfectly illustrates the downward trend in market prices. These periods often follow economic downturns and can result in a slowdown in investment and economic activity.

Understanding these trends can help you decide when to buy or sell stocks. For instance, entering the market in a bull phase might mean higher prices, but riding the wave could lead to significant gains.

Conversely, a bear market might seem risky, but it can offer opportunities to buy undervalued stocks that could rise in value when the market rebounds.

Strategies for Trading in Each Type of Market

Here are strategies I’ve found effective for trading in these contrasting market conditions:

In Bull Markets:

- Stay the Course: This is a time to leverage the upward trend. Consider holding onto your investments to benefit from the rising prices.

- Consider Buying Aggressively: Particularly in sectors that thrive during economic booms (like technology or consumer goods). These sectors often outperform in a bull market.

- Use Stop Orders: To protect gains. As stocks climb, you can use stop orders to automatically sell if the market takes a sudden dip, locking in your profits.

In Bear Markets:

- Seek Safety in Quality: Invest in stocks with a history of stable earnings and strong fundamentals. Companies with solid track records are often better equipped to weather economic storms.

- Look for Dividend Yield: Stocks that pay dividends can provide a steady income even when market prices are falling.

- Consider Short Selling: This is a more advanced strategy, but it involves selling stocks you expect to decline in price soon. If you choose this route, be sure to manage your risk carefully.

General Tips:

- Stay Informed: Always keep an eye on market news and trends. The more informed you are, the better positioned you’ll be to make strategic decisions.

- Diversify Your Portfolio: This can help buffer against losses in any one investment or sector.

Market Sentiments: How Emotions and Psychology Affect Market Movements

The stock market isn’t just numbers and charts – it’s also about human emotions and psychology.

Understanding the role of market sentiment can be as crucial as financial analysis when it comes to trading. Here’s how these elements come into play:

Emotional Decision-Making:

- Investors often react emotionally to news and market shifts. Positive news can lead to a rush of optimism and buying, pushing prices up (reflecting a bullish sentiment). Conversely, negative news can trigger fear and selling, driving prices down (a bearish outlook).

Herd Behavior:

- This is when investors follow the actions of the majority, whether those actions are rational or not. It’s like when everyone around you starts buying a particular stock, and you feel the urge to buy it too, fearing missing out on potential gains.

Overconfidence:

- During bull markets, it’s common for investors to become overconfident. This can lead to taking on too much risk based on the belief that prices will continue to rise indefinitely.

Panic Selling:

- Similarly, a sharp drop in stock prices can lead to panic selling, exacerbating a market downturn as investors rush to cut losses without considering long-term implications.

Recognizing these psychological triggers can help you make more balanced decisions, avoiding the pitfalls of emotional trading.

Always aim to step back, assess the broader picture, and make informed choices based on sound financial analysis and not just gut reactions or crowd behavior.

Understanding Market Capitalization & Volatility

When it comes to selecting stocks and managing your portfolio, two critical factors you must consider are market capitalization and volatility.

These concepts provide insights into the size and stability of stocks, helping you align your investments with your risk tolerance and financial goals.

Market Capitalization:

- Definition: Market cap is the total value of a company’s outstanding shares. It’s calculated by multiplying the current stock price by the total number of outstanding shares.

- Impact on Stock Choice: Companies are categorized as large-cap, mid-cap, or small-cap based on their market cap. Large-cap companies are typically industry leaders and offer stability and steady returns, making them a safer bet during volatile or uncertain times.

Small and mid-cap companies, while riskier, can offer higher growth potential, suitable for investors willing to accept more risk for potentially greater returns. - Portfolio Management: Your investment strategy might involve a mix of different market caps to balance risk and return.

For example, a “core and satellite” strategy involves a core of stable, large-cap stocks supplemented by riskier, small to mid-cap stocks to fuel growth.

Volatility:

- Definition: Volatility measures the degree of variation in a stock’s price over time. High volatility means the stock price can change drastically in a short period, while low volatility indicates more stable performance.

- Impact on Stock Choice: Understanding volatility helps you gauge the risk of stock price fluctuations. If you prefer a conservative approach, you might lean towards low-volatility stocks.

However, if you’re a risk-taker looking for significant gains, high-volatility stocks might be more appealing. - Portfolio Management: Managing volatility within a portfolio often involves diversification – spreading your investments across various sectors, industries, and asset classes to mitigate risk.

Tools like beta coefficients can also help measure how much a stock might swing relative to the overall market.

Stock Market Operations

The Role of Regulatory Institutions

Navigating the stock market also means understanding the role of regulatory bodies like the SEC (Securities and Exchange Commission) in the USA, the FCA (Financial Conduct Authority) in the UK, and SEBI (Securities and Exchange Board of India) in India.

These institutions play critical roles in maintaining the integrity and efficiency of financial markets.

SEC, FCA, SEBI: Ensuring Fairness & Transparency

- SEC (Securities and Exchange Commission): The SEC enforces laws that ensure a level playing field for all investors and seeks to maintain fair, orderly & efficient markets.

- FCA (Financial Conduct Authority): The FCA regulates financial firms providing services to consumers and maintains the integrity of the UK’s financial markets.

- SEBI (Securities and Exchange Board of India): SEBI protects the interests of investors in securities and promotes the development of, and regulates, the securities market in India.

Impact on Market Fairness and Transparency:

- These regulatory bodies enforce rules that prevent fraud, insider trading, and other practices that could undermine investor confidence and the market’s stability.

- They require companies to disclose financial information and other significant developments, ensuring transparency and helping investors make informed decisions.

How Regulations Affect Everyday Trading & Investing:

- Investor Protection: Regulations ensure that you are less likely to be a victim of fraud and malpractices in the stock market.

This protection is crucial for individual investors who might not have the resources to conduct detailed due diligence on their own. - Market Stability: By monitoring and regulating stock market activities, these institutions help maintain stability in financial markets.

This is vital for preventing the kind of unchecked speculation that can lead to market bubbles and crashes. - Accessibility and Inclusivity: Regulations also aim to ensure that the financial markets are accessible and not skewed in favor of institutional investors.

This inclusivity encourages more participation from the general public, enhancing liquidity and market dynamics.

Looking Ahead: The Future of Stock Markets

Technological Advances & Stock Trading

As we look toward the future, technology’s influence on stock trading continues to grow. The rise of automated trading systems and artificial intelligence (AI) is reshaping how we interact with financial markets.

Let’s explore what this means for investors and traders.

The Rise of Automated Trading Systems & AI:

- Automated trading systems use algorithms to make trade decisions at speeds and volumes that are unmatchable by humans. These systems can analyze vast amounts of data to identify trading opportunities in milliseconds.

- AI extends this capability further, learning from market patterns and adapting over time, potentially predicting market moves before they happen.

How Technology Will Shape Trading Strategies:

- Personalized Trading: Future trading platforms will likely offer more personalized trading experiences, using AI to tailor strategies to individual risk profiles and investment goals.

- Predictive Analytics: The use of predictive analytics in trading strategies will become more prevalent. Traders will leverage AI-driven insights to anticipate market shifts, rather than simply reacting to them.

- Risk Management: Advanced algorithms will improve risk management by better assessing potential market disruptions and suggesting ways to mitigate losses.

In conclusion, the intersection of technology and stock trading is paving the way for more efficient, accessible, and intelligent market participation.

As technology continues to evolve, staying informed and adaptable will be key to navigating future markets successfully.

Conclusion

In this comprehensive guide, we’ve explored the essentials of the stock market, from understanding its basic mechanisms and key players to navigating complex investment strategies and regulatory environments.

As you continue on your investment journey, remember that the landscape of the stock market is ever-evolving.

Staying informed through continuous learning is not just beneficial; it’s essential.

Disclaimer:

This content is for informational purposes only and should not be considered financial advice.

Read full Disclaimer.